In 2016, realizing parts of our financial portfolio were working against the foundation’s mission, we made a move to engage in mission investing.

Mission investments are made by foundations to further their philanthropic goals. Mission investments (like impact investments) include any type of investment that is intended and designed to generate both a measurable social or environmental benefit and a financial return.

What is the point of philanthropy if the grants we make are potentially hurt by the way our investment dollars are used? For example, how can we say we care for the environment but hold investments in the oil industry? With mission investing, we are committed to ensuring that the foundation’s values are applied not only to decisions we make about our grantmaking dollars (often referred to as the 5% required payout) but also to our investment dollars (often referred as the other 95%). So through a series of discussions and values-confirming exercises we determined the following non-financial goals should be applied where possible to our financial portfolio.

From our investment policy statement: Footprint Foundation aims to align its philanthropic mission with its investments to serve its communities, including but not limited to, the underserved, or low income, population. The Foundation believes in preserving the environment for the local community & the planet as a whole and believes environmental sustainability is an issue of climate change as well as poverty. The Footprint Foundation believes in equity for all – racial, gender, & income equality - and aims to narrow and eventually close the economic opportunity gap for women & minorities. Where possible, the Foundation will also look to influence positive change in public education and integration of the arts in their communities.

Today we have aligned 100% of our portfolio with our philanthropic mission and values by supporting sustainable environments, holistic community responsible investing, and place-based investing.

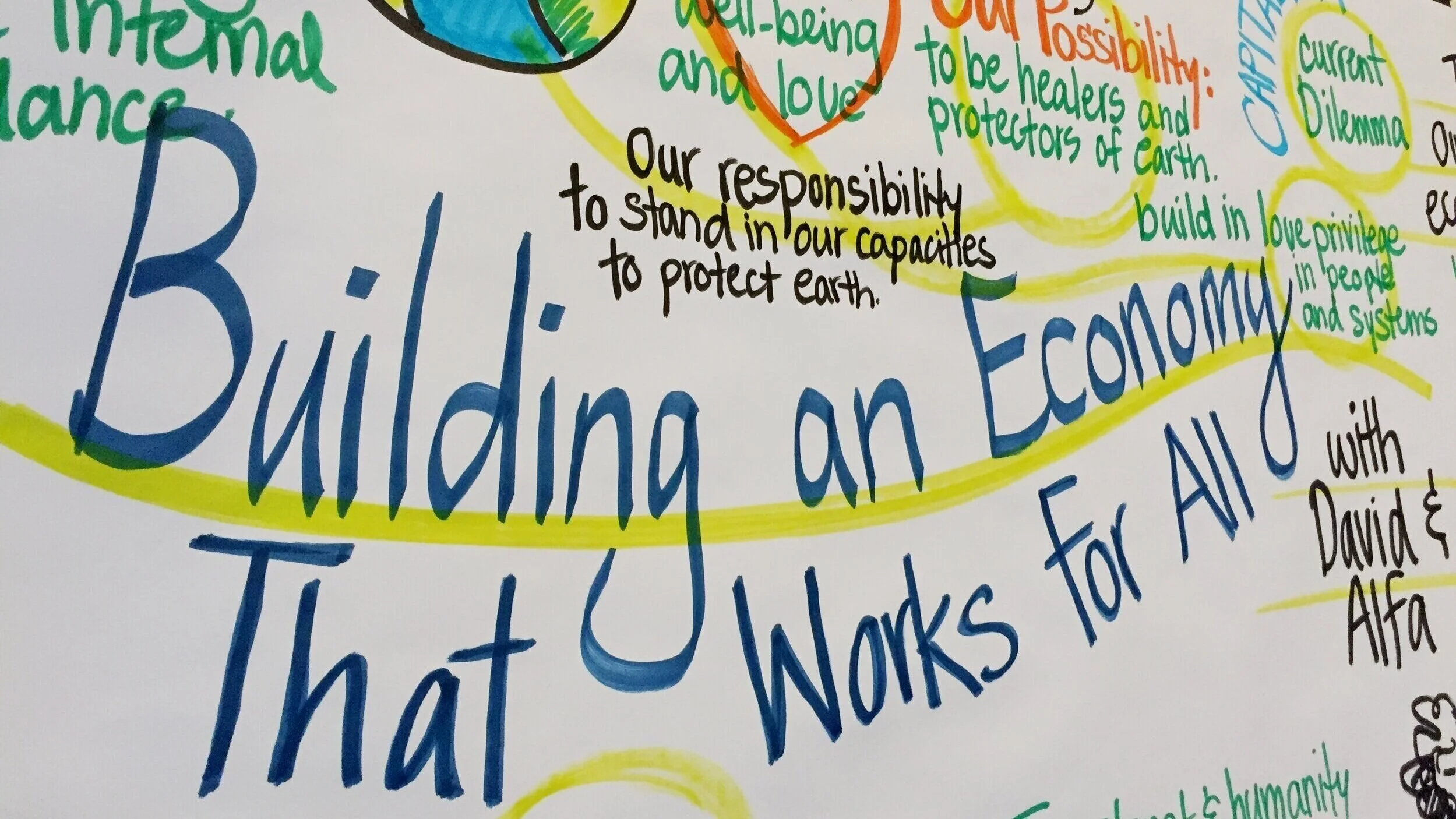

We continue to learn about ways we might shift dollars that traditionally support global investments to our local economy. Through organizations such as Slow Money, Common Future (formerly BALLE), and Boston Impact Initiative we are learning from systems disruptors who advocate for moving investments off of Wall Street to Main Street, thereby supporting businesses in local communities.

Here are some things we’re watching and reading: